Monday, March 30, 2009

Communities for a Clean Bill of Health says that Mississippians can be instrumental in reviving the cigarette tax increase for this session.

According to a release, your calls today to Lt. Gov. Phil Bryant, and to your Senator and Representative, will set the stage for another round of negotiations on the tax, and will support a bipartisan group of state legislators who petitioned to revive HB 364.

Tell Phil Bryant that these trying economic times, with looming cuts to healthcare and other programs, demand a $1 cigarette tax. Mississippi cannot afford to leave millions of dollars in potential revenue untapped. It's a win-win for all Mississippians - a win for Mississippi's budget and a win for Mississippi's healthcare. A $1 cigarette tax would result in:

• 20% percent reduction in youth smoking;

• 151 million in new revenue each year;

• $747 million in long-term health care savings.

Call the Lt. Governor at 601-359-3200. Click here to also find and contact your Senator and Representative.

Communities for a Clean Bill of Health is a statewide coalition that includes the Mississippi affiliates of the American Association of Retired Persons, the American Cancer Society, American Heart Association, American Lung Association, the Campaign for Tobacco Free Kinds and many more.

Previous Comments

- ID

- 145219

- Comment

Of course, if you are against the tax, you can also call Lt. Gov. Phil Bryant and your Senator and Representative and tell them you don't support any tax increase on cigarettes. Considering the federal excise tax on a carton of cigs goes up $10.39 on April 1, following a $3.90 federal excise tax per carton increase that went into effect in March, the tax on a carton of cigs, as of April 1, will have already increased $14.29. Add another $10.00 carton in taxes if this state tax passes and it will total $24.29 in new taxes on a carton of cigs in 2009. So, for example, a carton of Marlboro cigs which generally retails for $26.00, now costs $40.29 and will be $50.29 if the $1.00 a pack state tax passes. This means a lot of people will stop smoking because they've been taxed out of being able to afford the cigs, which is ultimately the main goal of all of these anti-smoking propaganda pushers. People quitting smoking wipes out Communities for a Clean Bill of Health claim of $151 million in new revenue. In fact, the revenue will decrease. It's so painfully obvious. The math doesn't lie.

- Author

- LambdaRisen

- Date

- 2009-03-30T10:40:07-06:00

- ID

- 145221

- Comment

Of course, you're right Lambda. But as a concerned citizen, I would still rather have healthy people than an additional source of state revenue. If the only way to stop people from smoking is to tax cigarettes out of existence, I'm all for it. My guess is that CCBH feels the same.

- Author

- Ronni_Mott

- Date

- 2009-03-30T11:00:07-06:00

- ID

- 145227

- Comment

The revenue will be there, because there are people who won't quit right away. They'll pay what it takes to maintain their fix. Sure, some will see the light and quit. Others will keep feeding their killer addiction.

- Author

- Ironghost

- Date

- 2009-03-30T12:12:31-06:00

- ID

- 145244

- Comment

Don't want to help revive it, want it to fade away.

- Author

- BubbaT

- Date

- 2009-03-30T16:17:53-06:00

- ID

- 145247

- Comment

It's back on, y'all.

- Author

- Ronni_Mott

- Date

- 2009-03-30T16:54:47-06:00

- ID

- 145255

- Comment

~>:[ Too bad we can't tax busy bodies, talk about annoying behavior, we'd be rich beyond imagination.

- Author

- WMartin

- Date

- 2009-03-31T07:19:57-06:00

- ID

- 145260

- Comment

"Busy bodies," WMartin? Would that me the anti-smoking advocates, the tobbaco lobbyists? the legislature, or other posters on this thread?

- Author

- Ronni_Mott

- Date

- 2009-03-31T08:59:03-06:00

- ID

- 145264

- Comment

Would that me the anti-smoking advocates... me? typo or Freudian slip? lol ...j/k You know, busy bodies, those that would stick their noses into other people's business and not only tell others how they should be living but attempt to force it upon them. It's the same thing that bugs me about the religious right.

- Author

- WMartin

- Date

- 2009-03-31T09:32:08-06:00

- ID

- 145266

- Comment

Completely Freudian, WMartin.

- Author

- Ronni_Mott

- Date

- 2009-03-31T10:00:42-06:00

- ID

- 145267

- Comment

The legislature didn't revive this out of some well meaning attempt to save the health of their constituents though. This is about car tags. http://www.wapt.com/money/19046097/detail.html

- Author

- WMartin

- Date

- 2009-03-31T10:04:03-06:00

- ID

- 145268

- Comment

It's never been about people's health, the tobbaco tax has alway been about the money.

- Author

- BubbaT

- Date

- 2009-03-31T10:28:01-06:00

- ID

- 145269

- Comment

Don't think so binary. It can be about both, Bubba, and it is.

- Author

- DonnaLadd

- Date

- 2009-03-31T10:31:45-06:00

- ID

- 145272

- Comment

WMartin: Bubba and yourself keep saying that like it's a bad thing.

- Author

- Ironghost

- Date

- 2009-03-31T12:01:41-06:00

- ID

- 145282

- Comment

You mean taxing the poor during an economic crisis so you won't have to pay as much for your car tag isn't a bad thing? What was I thinking? That sounds peachy. Maybe we can get them to throw in for some bridge repair while they are at it. They can just look at it as home improvements once we get the pound of flesh for them smoking.

- Author

- WMartin

- Date

- 2009-03-31T13:11:24-06:00

- ID

- 145283

- Comment

[quote]You mean taxing the poor during an economic crisis so you won't have to pay as much for your car tag isn't a bad thing?[/quote] ...Poor? Who said only the poor smoke? Smoking is a sick past-time that many from all economic classes take part in. And it looks like you're right: If you smoke, the rest of us will get cheaper tags. Don't like it? Don't smoke. :D

- Author

- Ironghost

- Date

- 2009-03-31T13:15:08-06:00

- ID

- 145285

- Comment

Well let's see; Gallup says this: Among those making $6,000 to $11,999 per year, 34% say they smoke, while only 13% in the top two income brackets (those with incomes of at least $90,000 per year) say the same -- a 21 percentage-point gap. http://www.gallup.com/poll/105550/Among-Americans-Smoking-Decreases-Income-Increases.aspx The NY times says: Even as antismoking campaigns have sharply reduced tobacco use in society at large, smoking has remained far more common among the poor of all races. http://www.nytimes.com/2007/10/20/health/20tobacco.html?_r=1&scp=4&sq=smoking+and+income&st=nyt

- Author

- WMartin

- Date

- 2009-03-31T13:26:25-06:00

- ID

- 145286

- Comment

Y'all are getting this one twisted up. It's one thing to tax the poor on *groceries*; it's entirely another to tax them on the very thing that will make them sicker, and cost them more as a result (and mean that society has to pay their heath-care costs). Thus, I really can't feel bad about making it harder, or more expensive, for the poor to smoke. In fact, I believe in states that have significant tobacco taxes, it is true that the taxes do decrease their smoking. Thus, high tobacco taxes are a win all the way around: for the smoker, for the taxpayer, for the governments. Except, of course, for the tobacco companies. And that's where Barbour is most concerned.

- Author

- DonnaLadd

- Date

- 2009-03-31T13:33:28-06:00

- ID

- 145291

- Comment

How is high taxes a win for smokers?

- Author

- BubbaT

- Date

- 2009-03-31T13:59:45-06:00

- ID

- 145294

- Comment

Uh, by encouraging them to give up a disgusting, often-fatal habit? (And not model it for their kids.) I've met very few people over 21 who actually still thinks smoking is cool. Higher taxes gives them good incentive to do what most want to do anyway: quit.

- Author

- DonnaLadd

- Date

- 2009-03-31T14:08:22-06:00

- ID

- 145295

- Comment

See how our legislature works? First they use the "health and revenue" excuse for this tax. Now they've pulled out the double-barrell shotgun scare: if we don't raise these here cigarette taxes, you car tags are gonna double! My car tags wouldn't double if they'd take money they mysteriously found this session to fund brand new projects and instead use it to make sure car tags wouldn't double. The governor just signed a "wrongful imprisonment" bill that pays anyone put in jail, but later found out to be innocent, $10,000 per year for every year they were incarcerated, up to $500,000. How are they going to fund that? We're broke, remember? We gotta raise cig taxes just to avoid car tags doubling in cost. BUT we have money to pay reparations to prisoners! Gotta love our legislature...

- Author

- LambdaRisen

- Date

- 2009-03-31T14:09:54-06:00

- ID

- 145297

- Comment

Still not a win for smokers who don't want to quit, like me. :)

- Author

- BubbaT

- Date

- 2009-03-31T14:13:24-06:00

- ID

- 145298

- Comment

Actually, we need money from somewhere to pay for health-care costs for the poor, many of which result from smoking and poor diets. It's got to come from somewhere; it makes perfect sense to spell that out for people. And it makes perfect sense to tax people on their unhealthy habits that creates a burden on the rest of us. It's interesting that someone points out that more poor people smoke, thus creating more public health-care costs. In turn, it makes sense that the source of much of the health issues -- cigarettes -- be taxed higher, both to help pay for the extra health-care costs, and to discourage them from smoking in the first place. And frankly, better-off people can afford to pay the higher tobacco taxes if they so choose. It's pretty brilliant and fair when you take time to think it through.

- Author

- DonnaLadd

- Date

- 2009-03-31T14:16:19-06:00

- ID

- 145299

- Comment

Bubba, then don't quit. It's your choice to do things that are unhealthy to yourself. But you can pay more taxes based on something you choose to do like smoke, that collectively hurts society, rather than have the burden spread over everyone who drives a car. Again, perfect sense.

- Author

- DonnaLadd

- Date

- 2009-03-31T14:17:21-06:00

- ID

- 145300

- Comment

You also probably pay more health insurance because you smoke, right? Do you object to that?

- Author

- DonnaLadd

- Date

- 2009-03-31T14:19:11-06:00

- ID

- 145301

- Comment

I have to admit it, Lambda, Bubba T, WMartin, et al. You folks just astound me with your logic. You want to argue for individual smoking rights in the face of documented proof (warehouses of it) that smoking makes people deathly ill and kills them prematurely. So I guess I should believe it's more important to let people kill themselves than it is to actually care for them. Then you want to tell us that it's disciminating against the poor to raise taxes on smoking, although there's another warehouse of evidence that the poor ARE THE VICTIMS of smoking--perhaps because some of them don't have the sense to get in out of the rain. Please, tell me how the poor benefit from smoking. Now you want to argue against giving reparations to people the state wrongfully puts into prison--the same people whose lives are irreparably damaged for years at a time and who are, for the most part THE POOR who can't afford decent lawyers. And for this you want to make comparisons about increases for your car tags? That one just broke my perverbial camel's back.

- Author

- Ronni_Mott

- Date

- 2009-03-31T14:30:42-06:00

- ID

- 145303

- Comment

Ronni- where did the reparations for people wrongfully put in jail come from? Oops Didn't read all of Lambda's post. That is a kinda lame thing to argue about. They deserve reparations if they were wrongly put in prison.

- Author

- BubbaT

- Date

- 2009-03-31T14:44:47-06:00

- ID

- 145310

- Comment

You want to argue for individual smoking rights in the face of documented proof (warehouses of it) that smoking makes people deathly ill and kills them prematurely. So I guess I should believe it's more important to let people kill themselves than it is to actually care for them. I am not arguing for the individual's right to smoke. Outlawing smoking outright is not at issue here. Although, it would be a more honest campaign seeing as how that is the end that these means are supposed to justify. Then you want to tell us that it's disciminating against the poor to raise taxes on smoking, although there's another warehouse of evidence that the poor ARE THE VICTIMS of smoking--perhaps because some of them don't have the sense to get in out of the rain. Please, tell me how the poor benefit from smoking. This tax increase is targeted at smokers. Fact. Most smokers are lower income people. Fact. I.e. This tax increase is primarily targeted at lower income people. Which part of that logic is so astounding? You should see my card tricks if you think that's astounding. As to your point about how much sense poor people have, well, that's not a crime and to use the law to punish people for individual freedoms or for not having as much sense as you just doesn't sit right with me. Smoker or not. I have said this before but I'll say it again. Just because something isn't "healthy" doesn't automatically make it wrong or even criminal. Everyone talks about all the money spent treating smokers for disease but there is an offset between that and the money they don't use in social security and for other medical problems because they don't live as long. Just because someone doesn't smoke doesn't mean they are going to be healthy and die at home in bed.

- Author

- WMartin

- Date

- 2009-03-31T15:41:31-06:00

- ID

- 145311

- Comment

BubbaT, there's hope for you, yet ;-)

- Author

- Ronni_Mott

- Date

- 2009-03-31T15:42:20-06:00

- ID

- 145322

- Comment

This tax increase is targeted at smokers. Fact. Most smokers are lower income people. Fact. I.e. This tax increase is primarily targeted at lower income people. Which part of that logic is so astounding? That's faulty logic, WMartin. Just because more poor people smoke doesn't mean an increased tax is "targeted" toward the poor, any more than because I'm blonde, I have more fun. It's twisting the issue to make it look as if the tax is specifically picking on people because they're poor instead of specifically targeting those who put an unfair burden of health costs on the rest of us. I admit that my crack about not having sense is wrong. But the poor generally do not have the resources to research issues. Internet access, and access to computers, for example, is a real problem for many, especially the rural poor in Mississippi. The information they do get, therefore, is heavily skewed toward sources like advertising, which hardly gives them a level playing field. And, WMartin, you have yet to tell me how the poor benefit from smoking. Smoking isn't just "unhealthy," which puts such a benign face on the habit--on par with not brushing after eating or going out in the rain without your umbrella. Smoking is deadly. there is an offset between that and the money they don't use in social security and for other medical problems because they don't live as long. That's insurance-geek actuary talk. So we should just let them die because they'll do it quickly? The truth is, treatments for cardio-vascular diseases, including cancer and therapies needed for heart attack and stroke recovery are some of the most expensive medical treatments available. Using words like "wrong" and "criminal" adds a moral element to this conversation that doesn't exist. No one is using those words here, WMartin, unless you want to say that allowing smokers to continue to unfairly burden a health care system already stressed to its limits is wrong. I don't care if people want to smoke as long as I don't have to share their airspace, for the most part. If they do, they should pay for their own medical treatment, which is all this tax hopes to do.

- Author

- Ronni_Mott

- Date

- 2009-03-31T16:18:04-06:00

- ID

- 145324

- Comment

That is a logical fallacy, W. Martin. I forget which one because I always forget what they're called! Clearly, the tax is targeted at everyone who smokes. And it's pretty twisted to argue about "regressive" tobacco taxes, no?

- Author

- DonnaLadd

- Date

- 2009-03-31T16:30:06-06:00

- ID

- 145325

- Comment

Yeah, that post by Lambda about "reparations" is no one of the more impressive I've seen here in a while.

- Author

- DonnaLadd

- Date

- 2009-03-31T16:31:31-06:00

- ID

- 145326

- Comment

@ ladd: And why is that? Merriam-Webster defines "reparations" as "the act of making amends, offering expiation, or giving satisfaction for a wrong or injury". Is that not what giving someone $10,000 for every year they were wrongly jailed, called? My point was, don't scare me Mr. Big Bad Legislature with threats about my car tag doubling because the state doesn't have any money.. but yet you found some money to pay for these reparations.

- Author

- LambdaRisen

- Date

- 2009-03-31T16:49:53-06:00

- ID

- 145328

- Comment

It's not the use of the word that was silly. It is your mockery of the idea that the state should pay someone it wrongly imprisoned. Otherwise, let's not veer too far from the cigarette tax. That's the subject of this post.

- Author

- DonnaLadd

- Date

- 2009-03-31T17:00:48-06:00

- ID

- 145331

- Comment

That's faulty logic, WMartin. Just because more poor people smoke doesn't mean an increased tax is "targeted" toward the poor, any more than because I'm blonde, I have more fun. The only problem in logic there is what you added. You added a generalization which isn't necessarily true, the assertion that blondes have more fun. Which I am sorry that for you it turns out not to be a fact. In this case your refusal to accept facts doesn't make my logic faulty. Whether or not it is the intention to specifically target lower income people with this tax increase that is in effect what it does. And, WMartin, you have yet to tell me how the poor benefit from smoking. How does anyone benefit from a glass of wine? a cold beer? a motorcycle? bungee jumping? mountain climbing? etc... There are plenty of risky behaviors that have no obvious outward benefit for the people engaged in them. Sometimes fun and enjoyment are all the benefit that's necessary. Will every risky behavior be taxed out of existence because we need to pay for health care for all? That's insurance-geek actuary talk. So if I make a point that's valid I get to be a geek? Who started counting pennies for health care? Remember, that is supposedly what this is about. lol Smoking isn't just "unhealthy," which puts such a benign face on the habit--on par with not brushing after eating or going out in the rain without your umbrella. Smoking is deadly. You accuse me of down playing the effects and then make it sound like if you light up a cig you are playing Russian roulette with a semi automatic pistol. If you could detach from the emotion you would realize smoking is just unhealthy. It wont kill you today or tomorrow, well unless you set your house on fire with you in it, it will take years off your expected life. The one's at the end, where a lot of people are in a nursing home soiling themselves. I'll trade those for a smoke today, thank you. That is assuming, of course, you don't get killed crossing the street, by a drunk driver or the million other ways people who may or may not smoke are killed everyday. Using words like "wrong" and "criminal" adds a moral element to this conversation that doesn't exist. No one is using those words here, WMartin, unless you want to say that allowing smokers to continue to unfairly burden a health care system already stressed to its limits is wrong. This tax has been described as punitive. Punitive: inflicting, involving, or aiming at punishment Societies define crime as the breach of one or more rules or laws for which some governing authority or force may ultimately prescribe a punishment. The proponents of this bill want to use the power of law to punish those who smoke. It is why I equate the tax to making smoking criminal. Who says that smokers are "unfairly" burdening the health care system? Why is it any more fair to treat a non-smoker for some disease than a smoker? Because they engage in risky behavior? What about (please see above risky behaviors or insert your favorite)? I don't care if people want to smoke as long as I don't have to share their airspace, for the most part. Really?

- Author

- WMartin

- Date

- 2009-03-31T17:33:57-06:00

- ID

- 145333

- Comment

It's basic, WMartin. Just because "more" of a certain group do something (like smoke), it simply does not follow that a penalty on it (like a tax) "targets" them. Sorry. Doesn't. I say that without a smidgen of "emotion." There is plenty of research at the ready about the effect that smoking has on health, as well as the health-care system. Just because you prefer it not to be true does not mean that it isn't.

- Author

- DonnaLadd

- Date

- 2009-03-31T17:53:46-06:00

- ID

- 145336

- Comment

[quote]My point was, don't scare me Mr. Big Bad Legislature with threats about my car tag doubling because the state doesn't have any money.. but yet you found some money to pay for these reparations. [/quote] The amazing thing is that if the State wants to avoid paying reparations, they can be more careful in their prosecution. Gather more evidence, train people better, fund the crime lab and keep on top of changes in forensics. All would keep more innocent people out of jail, thus avoiding reparations. All the state has to do is take a few simple steps to avoid the Reparations. Likewise, if you're tired of the state taxing your proven fatal habit, quit smoking. Thus you avoid paying that tax you hate.

- Author

- Ironghost

- Date

- 2009-03-31T19:13:58-06:00

- ID

- 145337

- Comment

Well, if a cigarette tax doesn't target just smokers, who does it target? Non-smokers aren't paying extra taxes.

- Author

- BubbaT

- Date

- 2009-03-31T19:16:30-06:00

- ID

- 145339

- Comment

Of course it targets smokers! The discussion with WMartin is whether it is intentionally targeting *poor* smokers, Bubba. Keep up! (smile) And right, Iron. I agree with you (alert the media). Expensive reparations for things like what DeLaughter et al did to Cedric Willis will help keep innocent people out of prison. And there ain't much more honorable thing our society can work toward together than that.

- Author

- DonnaLadd

- Date

- 2009-03-31T19:22:22-06:00

- ID

- 145342

- Comment

I'm alittle slow today, only had one pot of coffee. :)

- Author

- BubbaT

- Date

- 2009-03-31T19:28:44-06:00

- ID

- 145346

- Comment

your refusal to accept facts doesn't make my logic faulty. Whether or not it is the intention to specifically target lower income people with this tax increase that is in effect what it does. The "facts" I'm refusing to accept are your faulty conclusions. All sales taxes disproportionately affect the poor. Use of the word "target" implies intention, and the only intentionally targeted group for this tax is smokers. The tax affects smokers. If the majority of smokers are also black, is it a racist tax? If they're majority men, is it a sexist tax? If the majority are also between 34 and 55, is it an anti-middle-age tax? If the majority is obese, is it an anti-fat-person tax? Follow me here. The answer is "No." Just because a group of people do something more than another group, taxing the behavior is not necessarily "targeting" the group. There are plenty of risky behaviors that have no obvious outward benefit for the people engaged in them. Sometimes fun and enjoyment are all the benefit that's necessary. Will every risky behavior be taxed out of existence because we need to pay for health care for all? Really, WMartin? Fun? Statistically, at least 70 percent of smokers want to quit, probably more. Of the 40 percent who try, about half fail because smoking is at least as addictive as cocaine. That doesn't sound like behavior resulting from fun, enjoyable pursuits. It sounds like addicts trying to get a monkey off their back. We regulate many risky behaviors already, including drinking and driving, and many "fun and enjoyable" recreational drugs. But take all of the fun risky behaviors you mention and add up all the resulting deaths this year and you probably won't get close to the number of deaths caused by smoking. Not even alcohol-related deaths (around 75,000 a year) come close to smoking-related deaths (around 440,000 a year). Doctors and medical researchers have named smoking the number one *preventable* cause of death in the United States. If you could detach from the emotion you would realize smoking is just unhealthy. It wont kill you today or tomorrow, well unless you set your house on fire with you in it, it will take years off your expected life. Emotional is how I'm built, WMartin. Estimates are that smoking takes an average of 13 years off your life if you're a man, 14.5 if you're a woman. Life expectancy in Mississippi is about 73.5 years, which means a smoker will live to an average of 59 or 60. Hardly the age at which most of us will be "soiling" ourselves in a nursing home. Of course, if you're an African American man, your life expectancy is already about five years less than the American average, so now we're talking about living to the ripe old age of 54. And I do equate smoking with playing Russian Roulette. About half the people who smoke will die because of it. And not only is smoking unequivocally linked to many diseases, it also exacerbates unrelated health conditions. According to the American Lung Association, smoking is directly responsible for about 90 percent of the deaths due to lung cancer and 30 percent of all cancers. Smoking is also responsible for the majority of deaths due to chronic obstructive pulmonary disease (COPD), which includes emphysema and chronic bronchitis. All forms of tobacco raise one's heart attack risk. Smoking, chewing tobacco and being exposed to secondhand smoke greatly increase one's risk of a heart attack. In some cases, the risk of heart problems in people who smoke or are exposed to smoke may be three times greater, according to a study published in the Lancet. Pregnant women who smoke risk harming their babies. Smoking in pregnancy accounts for an estimated 20 to 30 percent of low-birth weight babies, up to 14 percent of preterm deliveries, and some 10 percent of all infant deaths. Even apparently healthy, full-term babies of smokers have been found to be born with narrowed airways and reduced lung function. Smoking during pregnancy is also linked sudden infant death syndrome (SIDS). Up to 5% of infant deaths could be prevented if pregnant women did not smoke. Long-term, smoking is a major cause of heart disease, aneurysms, bronchitis, emphysema, and stroke. It also makes pneumonia and asthma worse. Wounds take longer to heal and the immune system may not work as well in smokers as in non-smokers. Smoking damages the arteries. Because of this, many vascular surgeons refuse to operate on patients with peripheral artery disease (poor blood circulation in the arms and legs) unless they stop smoking. And if nothing else gets through, male smokers have a higher risk of sexual impotence (erectile dysfunction) the longer they smoke.

- Author

- Ronni_Mott

- Date

- 2009-03-31T20:30:53-06:00

- ID

- 145347

- Comment

So if I make a point that's valid I get to be a geek? I didn't call you a geek, I called the language you used geeky. And I'm not counting "pennies," for health care, BTW. We're talking about billions in smoking-related health care costs and lost productivity. Per the Lung Association, smoking cost the United States over $193 billion in 2004, including $97 billion in lost productivity and $96 billion in direct health care expenditures, or an average of $4,260 per adult smoker. Oh, and some of my best friends are geeks :-) Who says that smokers are "unfairly" burdening the health care system? Why is it any more fair to treat a non-smoker for some disease than a smoker? Because they engage in risky behavior? It's unfair because, for the most part, those diseases are preventable simply by stopping smoking. It's unfair because those of us who don't smoke have to foot the bill for those of us who do. And no, not every smoker will get cancer or heart disease, but the chances are a damn sight higher that they will. And not every person who doesn't smoke will live disease-free to 100, but the chances are a damn sight higher that they will. Do I care whether people smoke or not? Yeah, ultimately, I care simply because I care about all beings. I'm an addict myself, and I know how hard it is to quit. If taxing cigarettes out of the reach of most smokers prevents one person from starting to smoke or convinces one person to finally quit, it's worth it.

- Author

- Ronni_Mott

- Date

- 2009-03-31T20:31:19-06:00

- ID

- 145351

- Comment

Not to intrude, but I think she nailed you with this one, WMartin: If the majority of smokers are also black, is it a racist tax? If they're majority men, is it a sexist tax? If the majority are also between 34 and 55, is it an anti-middle-age tax? If the majority is obese, is it an anti-fat-person tax? Follow me here. The answer is "No." Just because a group of people do something more than another group, taxing the behavior is not necessarily "targeting" the group.

- Author

- Brian C Johnson

- Date

- 2009-03-31T21:39:35-06:00

- ID

- 145353

- Comment

Oh, and some of my best friends are geeks :-) Not to mention one of your bosses. ;-) And nicely argued, Ronni. I'll say it again: I held my daddy in my arms as he grasped for every breath over here in the V.A. hospital, and had to lift him out of the bathtub the last few days of his life. All because he smoked. And, yes, I'm emotional about that, and know that it is no way to die. And, yes, his smoking cost the taxpayers.

- Author

- DonnaLadd

- Date

- 2009-03-31T21:46:23-06:00

- ID

- 145355

- Comment

[quote]And right, Iron. I agree with you (alert the media). Expensive reparations for things like what DeLaughter et al did to Cedric Willis will help keep innocent people out of prison. And there ain't much more honorable thing our society can work toward together than that. [/quote] I think that's twice, so far. :) Putting a penalty on being wrong will probably be a wake up call. If it helps, they should penalize the county where the goof occurred.

- Author

- Ironghost

- Date

- 2009-03-31T22:26:09-06:00

- ID

- 145366

- Comment

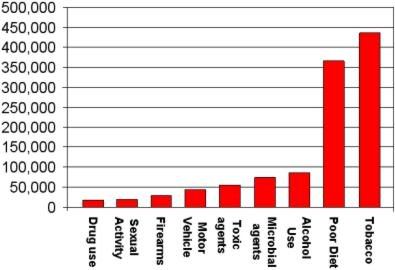

Not to intrude, but I think she nailed you with this one, WMartin: Ya think? I don't. It's like saying a tax on rental shoes doesn't target bowlers. Do I think the legislature intentionally wants to tax the poor to pay for health care? No. But it is the effect of what they are doing even though the money raised won't be enough to fund the shortfall in that budget. I don't believe the intention behind the tax is to pay for health care at all. As a matter of fact the only reason it's back is because there is a deficit in the fund to pay for the credits on car tags. And this isn't the last proposal for a tax increase on tobacco. The tax will continue to be raised until legally taxed tobacco is so expensive no one but the very rich can afford it or it is made illegal altogether. That is the true purpose behind it. If everyone chose to quit smoking tomorrow I would think that was fantastic. I am not arguing that smoking is good. I have never argued that. You can site reference after reference about the effects of smoking and it makes no difference in my argument, I concede the obvious. Smoking is bad for those that do it. I do believe that it is the individuals right to smoke if they want to, however. The monetary cost to society argument just doesn't hold up according to those insurance geeky types. ;-). If there were no smokers do you think the health care system would somehow be solvent? No, of course it wouldn't. So what then are we left with? You have a bunch of people who aren't happy that other people smoke. Why? Because they care about those people enough to take away their freedom. I worry that people listen to people like that. I think freedom should trump the hopeful wish that the government knows what's best for everyone. It's smokers today but when there are no more who gets targeted next when the money from taxing smokers is gone? I don't think it will be coming from bowlers and a tax on rental shoes. This graph shows the leading causes of preventable deaths annually:

Looks like it's going to be the people who don't eat like they are supposed to. Do we really want the government to be mommy and make sure we eat all our veggies? I like veggies but you get my drift, right?

Looks like it's going to be the people who don't eat like they are supposed to. Do we really want the government to be mommy and make sure we eat all our veggies? I like veggies but you get my drift, right?- Author

- WMartin

- Date

- 2009-04-01T07:50:51-06:00

- ID

- 145371

- Comment

WMartin, you refuse to accept that there is any difference between a tax that "affects" certain people and one that "targets" those people. There is a difference. Why don't you just argue that the tax has a disproportionate impact on poor people instead of continuing to insist that it "targets" them? It may seem like semantics, but there is a real distinction in terms of intent, which is important to other parts of your argument. "I don't believe the intention behind the tax is to pay for health care ..." I am not entirely unsympathetic to your argument, though I ultimately disagree. To me, taxing cigarettes at a higher rate is good conservative politics, because it forces individuals to take responsibility for their actions. I also agree that people have a right to smoke, and I get nervous about government paternalism. But why should the rest of us subsidize health care for smokers? I realize you think that's a red herring, but you don't really make a good case for your point. Taxes on cigarettes in general cannot be reduced to squabbles over car tags.

- Author

- Brian C Johnson

- Date

- 2009-04-01T08:28:07-06:00

- ID

- 145374

- Comment

Your point is well taken Brian. But I think you are misunderstanding my argument. Let me see if I can't be more clear. I believe the intention of these types of taxes is to make cigarettes (and ultimately all tobacco products) unaffordable. Not to fund health care, car tags or anything else. We all know that the rich can afford expensive taxes for luxury products. So who would a tax with such an intention target?

- Author

- WMartin

- Date

- 2009-04-01T09:12:17-06:00

- ID

- 145382

- Comment

I think freedom should trump the hopeful wish that the government knows what's best for everyone. Really, WMartin? We are a society of laws. Our society regulates a sh*t load of "freedoms" when they impinge on other people's "freedom" (e.g. murder, rape, robbery, etc.); when they "potentially" impinge on other's freedoms or present clear dangers (e.g. drinking when driving; carrying concealed weapons); when a "freedom" represents danger, or potential danger, to the society at large (e.g. selling ineffective or untested drugs, selling rotten meat or tainted peanut butter, licensing doctors); to support the operation of the government (e.g. taxes, fees and fines); to enforce the will of the people (e.g. suffrage); and a whole smorgasbord of other laws, regulations and levies. If freedom always trumps laws, WMartin, what you get is anarchy, not civilization. I'm not a personal fan of paternalism in any form, either, but smoking presents a clear and present danger, as your own chart represents so well. Do we really want the government to be mommy and make sure we eat all our veggies? Taxing the bejesus out of tobacco is one thing the government can do to lower use of the ONE single most lethal legal substance available. It is completely unlike trying to regulate diet, which is enormously complex because of the depth and breadth of the foods we consume. You can kill yourself by drinking too much water, or eating a diet of only lettuce or only rice, all items that are a part of a *balanced* healthy diet. But the government has taken steps in the arena of diet as well, by mandating nutritional labeling, for example, so that consumers can make *informed* choices. I'm grateful that I can see how many calories and what vitamins and additives are in the foods I buy. The information helps me make healthier choices. Personally, I am against a tax on all groceries, which also disproportionately affects the poor. If you really believe that raising cigarette taxes--in the face of all of the evidence presented here and by other researchers into the issue--is directly and cynically ONLY linked to the cost of car tags, then you haven't been paying attention. And, BTW, the monetary costs to society DO hold up. The figures cited are actual hard-dollar costs, not fantasy estimates based on theoretical actuarial tables. And, please, don't try to connect the cost of tobacco use to the solvency of the entire health care system. You and I both know that systemic causes for health care's failure to meet the needs of millions of American people is multi-dimensional. To say one action can solve the entire issue is silver-bullet dreaming. Your issues with this tax are analogous to Barbour's issue with accepting federal dollars for unemployment: the tax/funds "might" cause some feared action in the future that we "might" not be able to control. How about we deal with right here, right now for once and actually get something accomplished instead of living out of our past-based fears or anticipation of an unknown future? That attitude accomplishes nothing and generates only more fear.

- Author

- Ronni_Mott

- Date

- 2009-04-01T10:24:52-06:00

- ID

- 145383

- Comment

I believe the intention of these types of taxes is to make cigarettes (and ultimately all tobacco products) unaffordable. Well, we finally agree on something regarding this issue, WMartin. Stop the presses. Given of all of the evidence about how bad tobacco is for consumers, that is not a bad thing. As to what the state does with the revenue generated from such a tax, are you suggesting that they not use it to plug budgetary holes? Last, but not least, the tax targets smokers. If that group is also majority poor, male, minority, middle-aged and obese (all statistically true, BTW), all of those groups will be affected. And everyone still has a choice to smoke or not.

- Author

- Ronni_Mott

- Date

- 2009-04-01T10:39:01-06:00

- ID

- 145386

- Comment

Well, we finally agree on something regarding this issue Actually, we agree on quite a bit regarding this. The crux of our disagreement, in my opinion, is should the government restrict and even prohibit people's freedom to smoke. You say it should I say it shouldn't. While I appreciate your arguments and even agree it is within the government's power to do so. We will have to agree to disagree on whether it should exercise that power to curtail the personal freedoms of the people regarding this particular issue. We should remember that every time the government prohibits a vice the unintended consequences are always a black market for it and the crime that comes with it.

- Author

- WMartin

- Date

- 2009-04-01T11:12:01-06:00

- ID

- 145396

- Comment

Maybe you're right, WMartin, that the ultimate point is to make smoking unaffordable, but if so, it's certainly an incremental approach. A $1 tax increase would bring cigarettes in Mississippi up to about $4.50 a pack? Or $5 a pack? Here in Chicago, they're about $8 a pack, and people seem to smoke like chimneys. (What is it about cities and smoking? Is it that more people wear black, and feel obligated to puff to complete the existential image? Or is it that they are more stressed out?)

- Author

- Brian C Johnson

- Date

- 2009-04-01T13:15:37-06:00

- ID

- 145410

- Comment

Given that cigarettes don't get you high, give you sexual satisfaction, get you across borders or have intrinsic value, I'd say the black market for them will be fairly small. Of course, I could be wrong, WMartin. You just never know.

- Author

- Ronni_Mott

- Date

- 2009-04-01T14:21:06-06:00

- ID

- 145430

- Comment

You're right Brian it's incremental, sort of the boiling the live frog metaphor. It's an end around because they can't ban smokes outright. Most people don't believe the government should get that involved in the personal lives of people. But it's also one of the worst things about it if you really think about it. The tax from it's inception can't do what it was supposedly proposed to do, it's not enough money to make any real difference in the problems health care has and it won't stop people from smoking if they want to. So what does it actually do? It disproportionately burdens the least able to carry more load, especially in these times, simply to make some people feel good about themselves because "they care" and gives the politicians the ability to say they did something about those problems.

- Author

- WMartin

- Date

- 2009-04-02T08:09:53-06:00

- ID

- 145438

- Comment

WMartin, could it be that you've swallowed Big Tobacco's rhetoric that you should be "allowed" to kill yourself with their product? The whole "freedom" conversation regarding this issue is disingenuous. I can understand fighting for a freedom that provides you with some kind of benefit, but I just don't buy the argument with a product that is not just a danger to the consumer, but also to those who don't choose to use the product via second-hand smoke, and even to unborn children (where are the pro-lifers now, I ask myself). Where does personal freedom end and culpability begin when others are negatively affected? And where does personal and corporate responsibility fit in? Please, no "slippery slope" explanations, which are just more fear-based b.s. BTW, if you look at what the anti-smoking health groups say, the $1 tax would have provided immediate revenue AND cut smoking considerably. Yes, it's incremental, but with all the fuss about less than $1, I can just imagine what people would do if the tax went higher.

- Author

- Ronni_Mott

- Date

- 2009-04-02T09:26:58-06:00

- ID

- 145447

- Comment

it's not enough money to make any real difference in the problems health care has and it won't stop people from smoking if they want to. So the option is to do nothing? Can we get your suggestions for curbing or eliminating the number one preventable source of death in America, WMartin, instead of just a barrage of criticism? Your cynical message about government control is on the record, loud and clear. Let's get to solving the problem now, please.

- Author

- Ronni_Mott

- Date

- 2009-04-02T11:03:50-06:00

- ID

- 145452

- Comment

I don't think my argument for freedom is disingenuous at all. Because I truly believe that people should have the right to choose for themselves, which they will continue to do anyway no matter how many laws are passed or taxes levied. Just look at how well the war on drugs is going, this is just a new front in that war. It's kinda funny because I would start from the same premise to argue for gay marriage against the fundamentalist Christians and I'm pretty sure we would be on the same side on that one. They will point to all sorts of societal ills and costs that we would incur if it were allowed not the least of which being the wrath of god. Ok, before you go ballistic hear me out. You and I know those claims are BS, and I'm not trying to imply that the numbers and arguments from anti smoking advocates are BS, but to those people they are very real and if they hold the power to impose their views on the rest of us they will have no problem doing just that. They are only trying to save us from ourselves. That sort of thinking should be frowned upon, with extreme prejudice. To me it's kind of like freedom of speech you don't have to agree with what people say to support their right to say it. Are we somehow benefited by the Klan spewing their hate? It's hard to explain sometimes but yeah, I think we are. Where does personal freedom end and culpability begin when others are negatively affected? And where does personal and corporate responsibility fit in? Great questions. In my opinion, it depends on what the negative affects are that we are talking about. I believe the monetary arguments about the costs of health care from smokers are a red herring once you look at the big picture. Just because one doesn't smoke doesn't mean they won't contract a disease and need treatment. Plus if a smoker does die earlier than a non smoker he doesn't collect social security or any other benefits. And what about the smokers who don't die early and when they do die it is from more natural causes like my grand dad? The point being, smoking a cigarette is not an automatic death sentence no more than the one we all got when we were born. If you mean the negative affects from second hand smoke. well, they are mostly exaggerated which I posted evidence of in earlier posts on a different thread about the same subject. Personal responsibility is kind of built in to smoking just look at the data on the health consequences of smoking. Corporate responsibility doesn't really figure into this discussion, and I'm not going to defend any practice of any corporation. Although it's odd that the government, both federal and local, is in the position of making more money from a company's product than the manufacturer while they simultaneously try to put it out of business.

- Author

- WMartin

- Date

- 2009-04-02T11:31:47-06:00

- ID

- 145456

- Comment

I can't believe you resorted to gay marriage argument. That's just sad and off topic. Then there's this whopper: [quote]I believe the monetary arguments about the costs of health care from smokers are a red herring once you look at the big picture. Just because one doesn't smoke doesn't mean they won't contract a disease and need treatment. Plus if a smoker does die earlier than a non smoker he doesn't collect social security or any other benefits.[/quote] So, you're saying "Go ahead! Let'em smoke. They'll die faster and save us money in the long run." The point of raising cigarette taxes is, I believe, two-fold. Raise money and save lives.

- Author

- Ironghost

- Date

- 2009-04-02T11:43:42-06:00

- ID

- 145457

- Comment

So the option is to do nothing? This is a logical fallacy called a false dichotomy. It assumes there are only two options, which is not true. What's wrong with what is being done now? Education and getting the word out has done so much for making people aware of the hazards. It has been enormously successful in reducing the numbers of people who do smoke and making it over all an uncool thing to do when it was viewed previously as the cat's pajama's. You know what I would respect more from the anti smoking activists and the government than the disingenuous way they are going about this problem now? If they did go for the outright ban. If they outlawed it and the penalty for being caught smoking was treatment for smoking. That way if you wanted to quit all you have to do to get help is to light up in public. While I think it wouldn't be the correct thing (for the reasons I keep posting again and again) I would think it's at least an honest attempt to achieve their goals.

- Author

- WMartin

- Date

- 2009-04-02T11:43:50-06:00

- ID

- 145464

- Comment

Iron, Believe it baby! I believe in freedom for all. Whether you like what they do or not. As to your point about what I'm saying. If you are going to make a point about what a smoker costs the system then you have to take the system into account. It doesn't happen in a vacuum. Does a smoker cost our system more than a non smoker? Maybe at the margins a little. But I think freedom from the nanny state is worth a little extra.

- Author

- WMartin

- Date

- 2009-04-02T12:04:20-06:00

- ID

- 145474

- Comment

Martin: I was referring to your flippant dismissal of the value of life. You're fine with smokers dying, because it will save the state some money in the long run?

- Author

- Ironghost

- Date

- 2009-04-02T14:04:11-06:00

- ID

- 145476

- Comment

Iron, Come on now. That is a gross mis-characterization of my point. I didn't say anything about being fine with people dying or saving money. As a matter of fact what I did say was, "If everyone chose to quit smoking tomorrow I would think that was fantastic. I am not arguing that smoking is good." The key word being that people CHOSE for themselves.

- Author

- WMartin

- Date

- 2009-04-02T14:35:03-06:00

- ID

- 145478

- Comment

Take Two: You did say their deaths would save us money. I can requote that. :)

- Author

- Ironghost

- Date

- 2009-04-02T15:11:02-06:00

- ID

- 145485

- Comment

I did make the point that when someone dies before their life expectancy that any benefits they might have received had they lived are saved. But to characterize it like I'm happy to see them die because we save money is just wrong. I really don't see how you get there from what I said. Just because I state a fact doesn't mean I am somehow pleased by it. I was making a larger point about the overall cost of a smoker on the system is lessened because of this fact. It's a point that none of the anti smoking people want to recognize when they are going on and on about how much it costs to treat smoking related illness. Which is only meant to inflame people because they know that most people believe that the government should not be so intrusive into their personal lives.

- Author

- WMartin

- Date

- 2009-04-02T16:37:35-06:00

- ID

- 145487

- Comment

[quote]It's a point that none of the anti smoking people want to recognize when they are going on and on about how much it costs to treat smoking related illness.[/quote] Anti-smoking advocates are focused on saving lives, not handing out faster ways to end it. [quote]Which is only meant to inflame people because they know that most people believe that the government should not be so intrusive into their personal lives. [/quote] "most people". Right. Another logical fallacy, there. Look, I've got other things to do this evening. Can you come up with some solutions? I'm tired of debating semantics.

- Author

- Ironghost

- Date

- 2009-04-02T16:49:24-06:00

- ID

- 145488

- Comment

WMartin, choice implies some degree of equity. You can choose between chocolate and vanilla ice cream, for example, if you like both. If you dislike one, a choice between the two is no choice at all. You say that corporate responsibility doesn't have a place in this conversation. But corporations are huge players in the piece. You can't simply ignore that because it doesn't fit into your "freedom for everything" paradigm. Big Tobacco spends billions every year in advertising and lobbying. Against that huge pile of money, a few million are spent in anti-tobacco education efforts (to answer your question of what's wrong with what's being done now). Those circumstances are not the makings of free choice. And in regard to your comparing smoking with gay marriage--and with all due respect to religious dogma--the "wrath of God" and "societal ills" are not exactly objective measures, regardless of how someone "feels" about it. No objective measure of harm exists for two people wanting to join in a civil/religious union, even if they are the same sex. Conversely, there's plenty of objective measures of harm from tobacco use, including $200 billion in costs and 440,000 annual deaths. We've just gotten rid of an administration that put subjective measures like "the wrath of God" ahead of objective good sense. Let's not go back there, please. And those costs, BTW, are what you're calling "at the margins, a little"? Wow.

How much money and how many deaths would it take to get to "front," "center" and "a lot"? You are totally correct in saying that this tax is an incremental measure. So try this for honest: If the U.S. Congress had the guts, they would have told Big Tobacco years ago that they need to find a product that doesn't kill half of their loyal customers over time. They would tell them that they have to fund the medical care of every person with proof that tobacco is the cause of their lung, throat or mouth cancer, or their heart or lung disease, or their premature baby, beginning from the year they were caught lying about their own research to Congress. They would tell Big Tobacco that they have to stop marketing their product, period. Big Tobacco has had decades to do the right thing and they haven't. I have absolutely no sympathy for them, and if the government wants to make more through taxing them than they make in profits, it's fine with me. They make some $45 billion in profits every year. Name one other product responsible for so much damage that our society allows to remain legal and freely available? Consumers shouldn't be criminalized, per your scenario regarding the drug war. They're not the villians of the piece. And please, stop already with the "drug war" comparisons. There's no black market for items that don't get you high, off, or across a border. Tobacco won't blow anyone up or get you cash from a pawnbroker, either. As such, I don't think there's much chance of it going underground except in an extremely limited way. If you have evidence otherwise, bring it on. I'm guessing you have a slippery-slope argument in there somewhere regarding the "nanny state." - Author

- Ronni_Mott

- Date

- 2009-04-02T16:54:16-06:00

- ID

- 145489

- Comment

Iron, Look at Ronni's post. Now that is a rebuttal to an argument not a fast mis-characterization of a couple of words. And then accuse me of debating semantics? LOL whatever...

- Author

- WMartin

- Date

- 2009-04-02T17:11:27-06:00

- ID

- 145494

- Comment

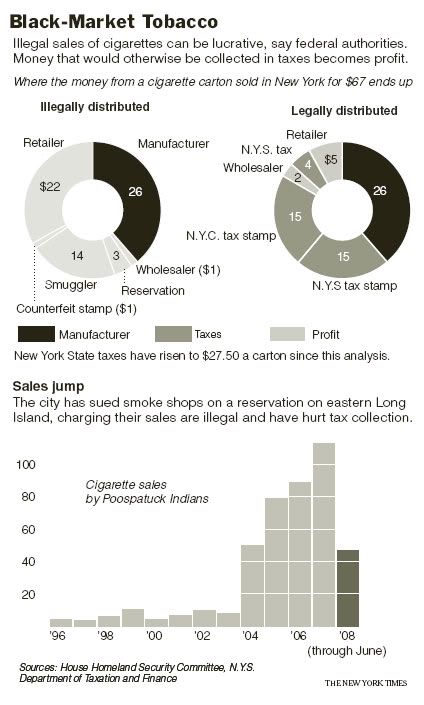

... with all due respect to religious dogma--the "wrath of God" and "societal ills" are not exactly objective measures, regardless of how someone "feels" about it. I'll leave answering how objective religious people are to someone who could do it with a straight face. Consumers shouldn't be criminalized, per your scenario regarding the drug war. They're not the villians of the piece. I agree. So why are they the one's paying the penalty for this punitive tax? If you have evidence (for a black market) otherwise, bring it on Ok. The first bit of evidence you already gave. The reason there will be a black market isn't that tobacco gets you high, off, or across a border. It's that there is a market that will support a $45 billion dollar profit while getting taxed through the yin yang. But if you don't believe me, here's some other stuff too.

http://www.nytimes.com/imagepages/2008/10/02/nyregion/02smoke.web.html

http://www.caltax.org/member/digest/june2001/jun01-08.htm

This article from the Huffington post explains,

"Illegal trafficking in cigarettes can generate enormous profits and is purportedly a multibillion dollar a year enterprise," the GAO said in a 2004 report. "Cigarette smuggling results in lost tax revenues, undermines government health policy objectives, can attract sophisticated and organized criminal groups, and could be a source of funding for terrorists."

Weiner's office pointed to a 2002 case where a federal jury in North Carolina found a man guilty of smuggling $7.9 million worth of cigarettes from North Carolina to Michigan. The man and his brother were accused of steering profits from their operation to Hezbollah.

But congress says they have no doubt they will be able to stop the illegal trade. I am not as confident as they are.

http://www.huffingtonpost.com/huff-wires/20080910/cigarette-smuggling/

http://news.bbc.co.uk/1/hi/uk/1169049.stm

http://www.nytimes.com/imagepages/2008/10/02/nyregion/02smoke.web.html

http://www.caltax.org/member/digest/june2001/jun01-08.htm

This article from the Huffington post explains,

"Illegal trafficking in cigarettes can generate enormous profits and is purportedly a multibillion dollar a year enterprise," the GAO said in a 2004 report. "Cigarette smuggling results in lost tax revenues, undermines government health policy objectives, can attract sophisticated and organized criminal groups, and could be a source of funding for terrorists."

Weiner's office pointed to a 2002 case where a federal jury in North Carolina found a man guilty of smuggling $7.9 million worth of cigarettes from North Carolina to Michigan. The man and his brother were accused of steering profits from their operation to Hezbollah.

But congress says they have no doubt they will be able to stop the illegal trade. I am not as confident as they are.

http://www.huffingtonpost.com/huff-wires/20080910/cigarette-smuggling/

http://news.bbc.co.uk/1/hi/uk/1169049.stm- Author

- WMartin

- Date

- 2009-04-03T06:42:07-06:00

- ID

- 145507

- Comment

OK, WMartin. There is currently a black market for tobacco products as a result of taxation. If Congress had the cajones to simply outlaw tobacco products outright (resulting in U.S. tobacco farmers and manufacturers moving on to something else) it seems like there would be much less of a problem. It's counterproductive and hypocritical for the U.S. to attempt to curb a market that it also supports through legal growing, manufacturing and distribution, although that behavior certainly isn't limited to tobacco. America has a bad habit of wanting to be the biggest bully on the block, dictating how the rest of the world should behave while doing the opposite. I can't help but see the black market as profitable today because cigarettes are so easy to get and sell. If they weren't, black marketeers would be limited to importing them or growing their own tobacco, and creating their own distribution venues, all of which would severely curtail profits and drive up costs, bringing it into the "extremely limited" realm I mentioned. But then, I don't think like a criminal, so who knows. We all know that Congress isn't going to take on the entire U.S. tobacco industry, though, and it's not going to level the field by matching their advertising and lobbying budgets with education and cessation efforts. Cessation isn't even covered by health insurance if you're lucky enough to have it. Clearly, it *ss-backward thinking by everyone involved, and health advocates are working that end of the issue as well. In the meantime, if raising taxes on cigarettes stops one kid from getting addicted, or makes one smoker quit for good, it's still worth it. If you can't afford the ticket, you don't get to ride. Citizens do not have the right to smoke, according to the Supreme Court, and government has the right to tax.

- Author

- Ronni_Mott

- Date

- 2009-04-03T12:01:03-06:00

- ID

- 145515

- Comment

Our government, both sate and federal, seems to have a hard time operating in an efficient and fiscally responsible manner. Instead they have to come up with new ways to tax the citizens. Today it's the old evil cigarettes, tomorrow who knows what it will be. As long as the people go along with these tactics, we can only expect more of the same.

- Author

- blueshead

- Date

- 2009-04-03T13:23:10-06:00