Wednesday, September 26, 2012

Mitt Romney is running for president on a platform of returning many costs to the states. Photo by R.L. Nave

Last week, a videographer caught Republican presidential candidate Mitt Romney in an unguarded moment during a political fundraiser.

"There are 47 percent of the people who will vote for the president no matter what," he said. "All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it, that that's an entitlement. And the government should give it to them. And they will vote for this president no matter what. ... These are people who pay no income tax."

He then added: "[M]y job is not to worry about those people. I'll never convince them they should take personal responsibility and care for their lives."

Regardless of where you stand politically on Romney's "inelegant" statement, as he called it later, a big question looms: Do 47 percent of Americans not pay federal income tax?

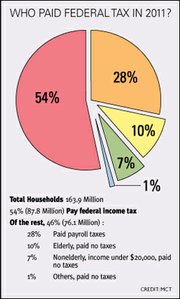

The short answer is yes. Well, sort of—the people who paid no federal income taxes in 2010 is 46.4 percent. The longer answer is more complicated. Here's the breakdown on who pays and doesn't pay income taxes, specifically federal income taxes:

Of those who didn't pay, Low income includes people not required to file (earning less than $9,500 per year), and those whose income falls below a certain threshold ($26,400 for a family of four in 2011).

The elderly get an additional standard deduction that lowers their tax liability. Some may receive non-taxable income from Social Security.

Many working poor are eligible to claim an Earned Income Tax Credit (a program put in place in 1975 under Republican President Gerald Ford) to reduce their tax liability. A family of four with two kids could make up to $45,775 last year and end up with zero liability using the EITC.

In the other benefits category are people who have taken advantage of a hodgepodge of other programs and deductions that reduced their federal tax liability to zero. Those include disability payments, interest on bonds, tax credits for education, charitable contributions, mortgage interest and other itemized deductions. Included in this last category are soldiers serving in war zones and, as The Atlantic magazine reported, roughly 7,000 millionaires.

Is It All About Income Taxes?

As the graph below shows, the majority of those who paid no federal income taxes did pay payroll taxes, which includes state taxes and contributions to Social Security and Medicare, programs designed to provide income and medical care for the elderly. Not specified are other taxes people may pay, such as property, sales and state income taxes, which vary from state-to-state and city-to-city.

Where Are the 47 Percent?

The Tax Foundation—another nonpartisan tax research group—compiled data showing where the majority of those not paying income taxes lives. Nine of the 10 states with the highest rate of non-payers are in South. Not coincidentally, they are also among the poorest states in the union.

Mississippi ranks at the top of the list of non-payers, which excludes those not required to file a return—one in four Mississippians live below the federal poverty threshold. Of all the Mississippi returns filed in 2010, 44.5 percent had no tax liability.

Roughly 1.3 million Mississippi individuals and households filed federal tax returns in 2010. Beyond that, determining exactly who paid federal taxes is difficult. Of those returns, 68 percent had taxable income; 55.5 percent, or 712,035, paid federal taxes. The difference between the two is likely attributable to a myriad of tax credits.

With three-quarters of all Mississippians reporting adjusted gross incomes of $50,000 or less, many of those who don't pay taxes fall into this middle- and low-income group, especially if they have children. Fifty-one percent of filers came in at less than $25,000, and of those, about a third reported they paid federal income taxes (meaning their taxes weren't zero). About 72 percent of those making $25,000 to $50,000 paid federal taxes. For filers with incomes greater than $50,000, the overwhelming majority paid taxes.

As in other areas of the country, Mississippi's disabled and the elderly are among those who probably have no federal tax liability. Disabled people account for slightly more than 16 percent of all Mississippians; however, the rate of disabled increases as income decreases. In 2008, for example, about 37 percent of low-income adults in the state were also disabled, reported Marianne Hill, senior economist for the Mississippi Institutions of Higher Learning in "Solving Mississippi's Poverty Problem."

Are the 47 Percent all Democrats?

Romney suggested that the 47 percent who pay no income tax are the same 47 percent who support Obama "no matter what." That analysis is inaccurate; today's Democratic voters are not necessarily the same group that does not pay federal taxes. So, who are the Democrats? The Associated Press quantified them as follows:

• Sixty-two percent work; including 10 percent part time. A fourth are retired. Five percent are temporarily unemployed.

• Most earn higher-than-average wages: 56 percent have household incomes above the U.S. median of $50,000; 20 percent have incomes of $100,000 or more; 16 percent have incomes below $30,000.

• They skew younger than Romney's voters: 20 percent are senior citizens, and 12 percent are under age 30.

• They're more educated than the overall population: 43 percent have four-year college degrees or above; 21 percent topped out with a high-school diploma.

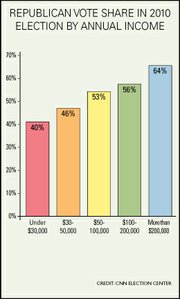

Looking strictly at the 46.4 percent of people who don't pay federal income taxes, their voting habits aren't as simple as Romney's statement. The poor generally vote Democratic, but they aren't a monolithic block, and they are less likely to vote. Seniors are more likely to cast a ballot than the poor. More than any other factor, income determines the party of the voter. As a general rule, the more money you have, the more likely it is that you will vote Republican.

Why Is This Important?

Since the days before Ronald Reagan's rhetorical "welfare queen" days, the modern Republican Party has a history of demonizing the poor. In that context, Romney's statement is just more of the same. However, the 47 percent is neither a monolithic voting block nor is it static; someone who owed no taxes last year may well owe this year.

Both the Republican and the Democratic parties have enacted tax policies that keep the poor and elderly from paying federal taxes that would be burdensome. Those who understand these dynamics know that non-payers are not irresponsible moochers and freeloaders, as Romney's statement would have us believe.