Thursday, March 30, 2017

The Mississippi Legislature passed the Capitol Complex bill to funnel extra tax revenue to the city of Jackson to help fix infrastructure in a certain portion of the city.

JACKSON — The Legislature passed the much-debated and anticipated Capitol Complex bill on the last day of their 2017 session, Wednesday, March 29. Both the House and the Senate passed the bill, which has changed substantially since its initial introduction, by wide-margin votes.

Mayor Tony Yarber thanked state legislative leaders at the capitol on Wednesday for working with the Hinds County delegation and city officials to get the bill passed in the midst of a tough budget year.

"The real message today that I received is that the state of Mississippi has made a real investment and turned the corner with the City of Jackson in terms of our relationship as the capital city," Yarber told reporters after the Senate passed the bill. "In increments ... the state of Mississippi will be diverting sales tax funds into a Capitol Complex improvement district (fund that will go towards) sidewalks, waterlines, streets, in a certain boundary, which allows us to use other funding in other parts of the city."

The funding influx is set to start on or before Aug. 15, 2018, the bill says, and Yarber said that the initial dollar amount would be more than $3 million.

"Any funding that comes into City of Jackson is a win for Jackson. It will give us an opportunity to move funds in certain areas, to areas that typically haven't seen any real investment," Yarber said. "So it's a win whether you live in north, south, east or west Jackson."

The funds will come from diverted sales-tax revenue collected on business activities within the city of Jackson, starting at 2 percent and incrementally increasing in subsequent years. Unlike Jackson's 1-percent sales tax, these new diversions don't represent additional taxes collected in Jackson; instead, more of the taxes that are currently collected from Jackson businesses will be used to fund the district's expenditures.

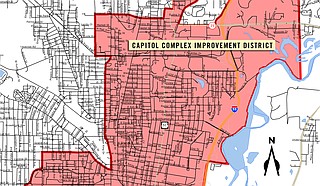

The actual Capitol Complex district's boundaries have a western border at Jackson State University and encompass downtown, going as far north as the Jackson Medical Mall and to a chunk of Fondren. The district expands east, across Interstate 55, to the Mississippi Museum of Natural Science and the Pearl River.

House Bill 1226 has been in the works since 2014, Yarber told the Jackson Free Press, and he said the bill likely passed as a result of engaging state leaders early and often.

The legislation also establishes a nine-member committee to advise the Mississippi Department of Finance and Administration on what improvement projects should be funded. The mayor of Jackson, a representative from city council and then several government appointees, including representatives from Jackson State University and the University of Mississippi Medical Center, will serve on the committee.

"Improvement projects shall be coordinated with the City of Jackson to the greatest extent possible," the bill says. However, improvement projects "shall not be subject to approvals, permits or fees assessed by the City of Jackson."

Yarber said he has a list of projects in the city that the committee could consider.

Sen. John Horhn, D-Jackson, who is also running for mayor, held a press conference to celebrate the bill passing on Wednesday. Horhn praised the work of his delegation and explained parts of the legislation.

Explaining one potentially controversial part of the bill, Horhn said it extends the Mississippi State Capitol police's authority to make arrests in the entire district. He emphasized that their law-enforcement authority will run in concurrence with the Jackson Police Department and the Hinds County Sheriff's Department.

Email state reporter Arielle Dreher at [email protected].